One of the things that makes us so curious about the top investors in the world is their frequent regrets that they had to start investing earlier. Even Warren Buffett, who started investing at the 11th age also stays in the same opinion (Buffett bought his first stock (3 stocks of ‘Cities Services preferred stock’ for $114.75) at the age of 11 and did his first real estate investment at the 14th age).

I am sure you are most possibly thinking how greedy these people are (or maybe freak), right? But the actual matter is that you will also say the same thing if you learn the power of early investing.

The power of compounding

I am now going to show you the incredible power of early investing by means of a hypothetical story.

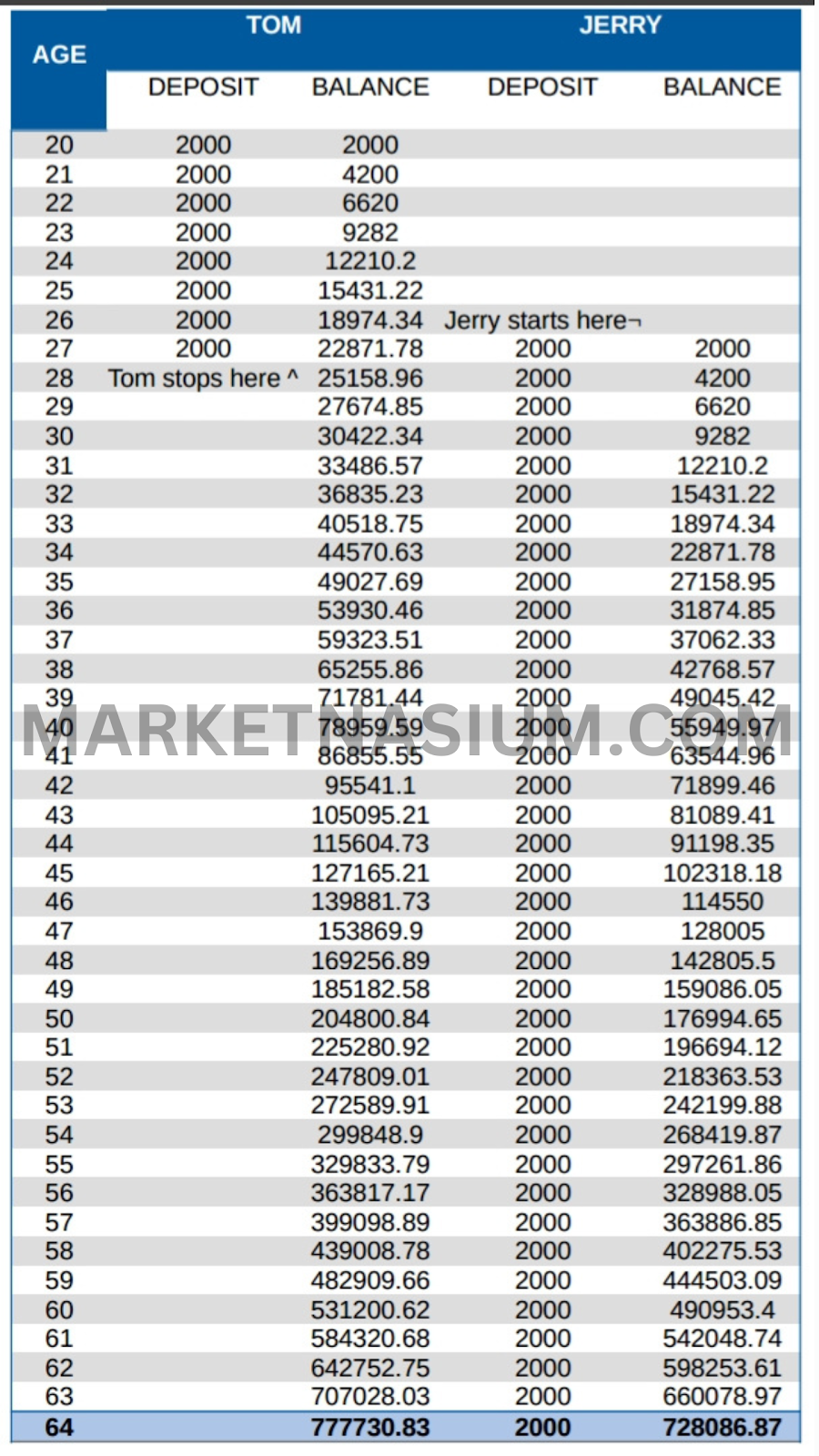

The protagonists of our story are two friends of the same age. Let me call them Tom and Jerry. Once on his 20th birthday, Tom got to read this post and realized how important it is to invest. He decides to invest the $2000 he had then, in a good bank for 10 percent annual interest (under compound interest). He pursued the same action for 7 more years (up to 27th age). Due to some matter, let’s say he got married at that age and her wife was a terrible shopper, he couldn’t able to invest further. Poor Tom!

And that was the time when Jerry got to read this post and found the importance of investing. Jerry was so active (and for sure, a smart wife controller). From Tom, he knew about the same bank. He started investing $2000 per year consistently up to when he was 64.

And at that age, when both retired from their work, met by chance at a coffee shop. They decided to go and withdraw the money they had invested in the bank.

Here the twist of our story comes!

Jerry got so mad at the officials there in the bank when he got to see the total balance in his account. It’s certain that he didn’t become angry seeing his balance of $728086.87, but instead on seeing his friend tom’s balance of 777730.83!

As a sum total, Jerry invested 2000*38 = $76000 and got a return of $728086.87

As a sum total, Tom invested 2000*8 = $16000 and got a return of $777730.83

Profit of Jerry = 728086.87 – 76000 = $652086.87

Profit of Tom = 777730.83 – 16000 = $761730.83

That means Mr. Tom got $109643.96 more than Mr. Jerry.

Why? (a big why?)

There didn’t happen any fouls. The bank officials started convincing Jerry that this is actually the magic of compounding.

Anyway, Tom became much happier than ever he was after his marriage (all credit goes to his wife).

Now can you explain how Tom got more in his account and Jerry less than Tom though he invested way more than Tom?

Here’s the table showing the overall transaction details:

I am pretty sure that you are also amazed to see the true power of early investing just as Jerry did. Though Tom had only invested for 8 years, he could able to get much more profit than Jerry who had invested for almost 38 long years, solely because of investing early. Here, consistency seems less potent than time. This is the reality!

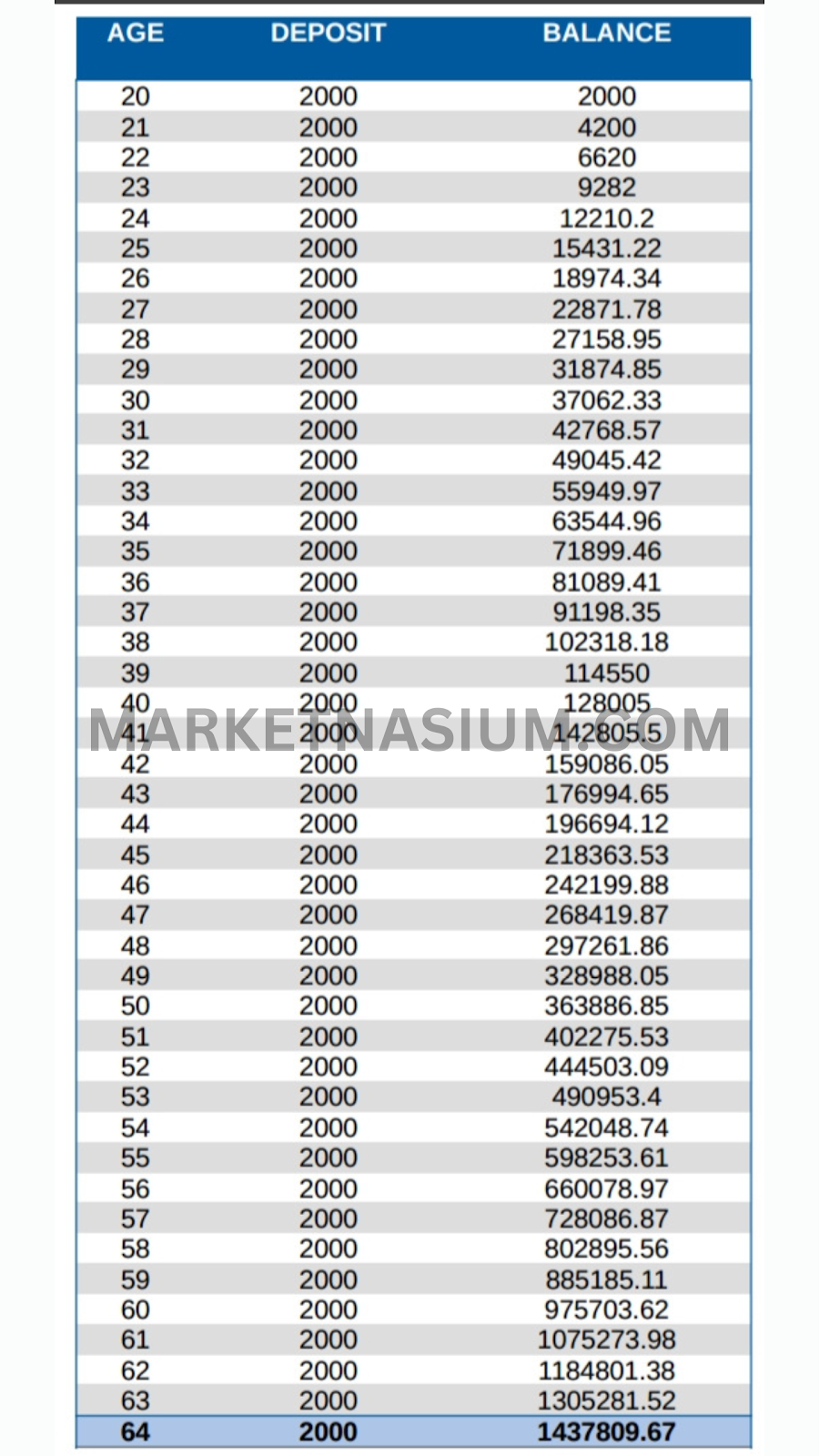

Now let us think about another person Bob, the same age as our protagonists, who is a smart and intelligent buddy, started investing in the same bank, the same amount ($2000), from the same day Tom invested for the first time and stood consistent upto the 64th age. His transaction details should look like this:

You can now appreciate the difference in profits that all three friends individually made.

Profit Jerry earned: 728086.87 – 76000 = $652086.87 (almost 6 and a half lakh dollars)

Profit Tom earned: 777730.83 – 16000 = $761730.83 (almost 7 and a half lakh dollars)

Profit Bob earned: 1437809.67 – 90000 = $1347809.67 (over 1 and a quarter million dollars!)

Now, who do you want to be (Tom, Jerry, or Bob)?

Time has, obviously, great importance in the field of investment. even if Bob lagged a year for starting investing(ie: instead of 20th age, he starts at 21st age), he would have lost $130528.15. One year worth him almost 1 and a quarter lakh dollars!

Here’s the outcome of this whole section:

“EARLY INVESTMENT AND CONSISTENCY IS ONE OF THE IMPORTANT TRAITS OF A GOOD INVESTOR”

HOW EARLY INVESTMENTS IN STOCKS CAN HELP?

The previous scenario, I have explained showed you a bank of 10% annual interest rate. But in reality, banks with that much higher interest rates are very scarce. Even if you put your money on the bank’s Fixed Deposit scheme itself, you may not able to get that much interest.

This is the case when we search for other investment fields. And of course, the stock market is the greatest opportunity for the common people to grow their money, by investing in IPO-registered companies.

What makes the stock market so special is not only the high rate of money growth but also the other things like dividends and voting authority in the company.

Do you know what is the average capital appreciation(increase in the money we invested) per year in the US market? It is about 11.88 percent by now(the time when I am writing this post). It’s true that there are companies that give even more than this 11.88% and even lesser than this 11.88 percentage increase.

Of course, we cannot avoid the chances of loss as well. There are companies that ruined over the course of time, depressing faithful investors. And conversely, many other companies yield more than 100 percent return in one year(which means double the money you invested with in one year).

Dividends make us a bit more happier. We get frequent returns from the profit of the company along with our invested money’s growth. Choosing a company according to its dividend-related aspects also makes us get more profit.

Most companies nowadays give dividends per quarter of a year (quart-year). The dividend rate depends. Many companies don’t give dividends as it’s not a strict thing for a company to do for the participants of common stocks. Likewise, a dividend-paying company can stop giving dividends at any instant. They can decide whether they have to pay or not the dividends for this year. The rate can also change. (on simply saying: it’s all upon the company to decide about the payment of dividends)

Coming back to our previous story, if Bob had done his investments in a growing company having consistent dividend payouts, by buying the stocks in the same fashion he deposited on the bank (ie, buying ‘x’ stocks for $2000 per year on the same company), he could get the same amount profit he got from the bank at his 64th age through one side(if and only if the company’s capital appreciation is consistently 10% per year) and frequent money return from dividends by the other side.

Let us suppose the company Bob had invested in for all these years up to his 64th age, gave a dividend yield of 2 percent the last year (before he withdrew the whole amount). Then, Bob could able to get $26996.193 completely from the company’s profit without touching any penny from his investments and gains.

2% of $1349809.67 = $26996.193

This is only the last year’s case. What about the previous year if the dividend yield of that year given by the company was 1.5%?

1.5% of 1305281.52 = $19579.223

You can now imagine how many dividends he had got all the previous years.

So as Bob selected a consistent-dividend company, he could able to earn more profit than from the bank.

It’s sure that there won’t be any stocks with consistent returns per year (the concept of a 10% increase per year is truly imaginative. I used it only for giving you a better understanding(and especially for convenience in my calculation)

IS DIVIDEND INVESTING A GOOD STRATEGY?

Now it’s time to check the power of early investment here in stocks.

Let us take the historical annual return table of Tesla stocks into our consideration. The company got its IPO (Initial Public Offering) in 2010. So let us take the historical data from 2010 to 2022.

Here from this table, you can really appreciate the profit you have gained by buying stocks of Tesla from 2010 to 2022. We can see that in the year 2020, the stock almost grew 7 times! So if we were so late to buy the stock, let’s suppose the year 2021, seeing the 2020’s glow, we would book a loss in the year 2022.

Here, it’s evident that the man who bought Tesla stocks in 2010-11 time has got much profit only because he started early investing.

It’s time to create another character for our story. I will call him Micky. He did the same thing that Bob did. That is: continuously investing $2000 per year. But the difference is that he didn’t choose that bank, instead, he chose Tesla stocks.

From 2010 onwards he started buying stocks(for convenience, I am not considering the stock price. Let’s think that he got x stocks with 2000 dollars, the next year n stocks with the new $2000, and so on). Here’s the chart showing his money growth:

What would have happened if Micky has took all his money in the last month of 2021 without investing the last 2000 dollars of 2022? Then he could able to get $1766965.163.

That means, the total investment of Micky = 2000*12 = 24000

Profit Micky earned = $1766965.163 – 24000 = $1742965.163

Compare this with the profit Bob earned through 44 years of investing in the bank with assured 10% interest.

Profit Bob earned = $1347809.67

Profit Micky earned = $1742965.163

cool right? Bob’s effort of 44 years reaped far lesser than Micky’s effort of 12 years. Thanks to Tesla.

(Tesla doesn’t provide dividends. There are other stocks that would give you capital appreciation + dividends)

The outcome of this whole section:

“IT’S EQUALLY IMPORTANT TO CHOOSE GOOD OPPORTUNITIES ALONG WITH EARLY INVESTMENT”

AT WHICH AGE SHOULD A PERSON START INVESTING?

The proper satisfactory explanation for this question (the conclusion of this entire post) is that the best time for investing is not anytime else, it’s now! If you didn’t start investing, start it right now.

Be an intelligent, smart, and active Investor and rock your life. All the best from Marketnasium.com.